Scope of Services

We work with all our clients on a monthly, fixed-fee model. Our fee is determined by the size of your organization, the complexity of your accounting needs, the number of monthly transactions, and the services we agree on together. This approach keeps things fair for everyone and allows you to budget accurately without facing unexpected bills each month.

Strong financial data, delivered to you promptly (no more waiting 45+ days for your current team to provide monthly reports), empowers you to make better-informed decisions based on financial facts—not guesses.

Our goal for every organization we work with is to:

- Strengthen communication between finance and organizational leadership

- Handle the financial work so you can focus on advancing your mission

- Provide accurate and timely financial reports

- Identify and address any financial inefficiencies in your operations

- Deliver advanced financial data to enhance your organization’s impact

- Ultimately, give you peace of mind knowing the financial side of your organization is secure

Frequently Asked Questions About Our Bookkeeping Services

Several small business owners prefer doing basic bookkeeping tasks themselves in an effort to save money. However, once they realize how much time they can save by hiring a bookkeeping service for startups, they won’t want to go back.

Working with outsourced bookkeepers for your startup is one of the best decisions you can make if you want to start making better financial decisions.

Our goal is to take the guesswork out of the equation by providing you with accurate financial records surrounding your company. This will help you focus on other important aspects of your work while we handle the rest.

Do you want to learn more about our outsourced bookkeeping services for startups? Keep reading this section!

Is Hiring a Bookkeeper for a Small Business Worth It?

Is a bookkeeper needed for a small business? The short answer is “yes.”

As mentioned in the introduction, some people believe they save money by doing their bookkeeping themselves, but that’s not quite true.

When you hire outsourced bookkeepers for your startup, you lower the chances of human errors, missed reports, inaccurate financial statements, and more.

Thankfully, bookkeeping services for startups will allow you to focus on other vital aspects of your business while our team helps promote a higher cash flow through our detailed reports.

It doesn’t matter whether you’re considering growing your business in the future or not. You must always have a sense of how much money you’re gaining and how much it’s going out. Besides helping you plan your business’ finances, a bookkeeping service for startups will also help you fulfill your legal obligations.

A bookkeeper will also ensure that all your business expenses/records are stored and updated accordingly, preventing discrepancies with your VAT or tax returns.

To summarize, an outsourced bookkeeping solution will help you with your company’s:

- Organization

- Financial Analysis

- Planning

- Budgeting

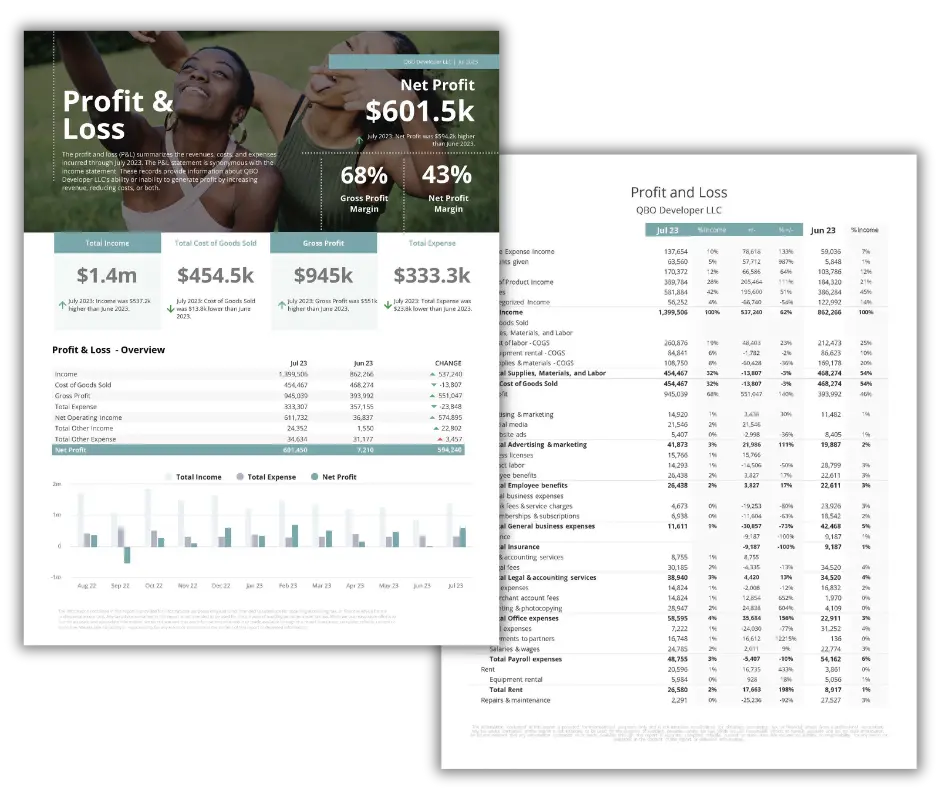

One of the worst decisions you can make as an owner is to rely on printed P&Ls you got from other accounting services/software. First, you must analyze all the data you’re getting from your business, and that’s where our online bookkeeping service comes in.

How Does the Calculated Growth Model Work?

Our CGM is a proprietary system that will ensure you measure the financial impact of all your business decisions accordingly. Moreover, this system will also help you evaluate how you can maximize your company’s value.

It uses a three-pronged approach, which will help you make the most out of all the financial information you’re getting. You can read more about this system on our website.

When Should I Hire Bookkeepers to Work with My Bookkeeping Software?

Do you need to outsource bookkeeping for a small craft business? We got you covered! Overall, outsourced bookkeeping for startups is needed as soon as you start your project.

Some business owners believe they have to wait until they have a problem with their cash flow statement or any other data to consider hiring professional bookkeepers. Remember bookkeepers will help you manage, analyze, record, and organize your financial transactions, and they will outline everything accordingly in your future financial statements.

If you don’t hire a bookkeeper soon, you could end up with days, weeks, or months’ worth of invoices and receipts you didn’t process, which will make you lose time and money.

Is Hiring a Bookkeeper for a Small Business Worth It?

Finding the right person or team to outsource bookkeeping for your small business can be tricky; trusting your financial information to someone else isn’t easy, and that’s why we offer our discovery call to potential clients.

Any business owner interested in our outsourced bookkeeping service can click on the “Schedule a Discovery Call” button to get started. Then, they can choose a date and time when they would like to receive a call.

Finally, all that’s left to do is wait until one of our team representatives gets in touch with them.

Here, you will be able to ask any questions you have surrounding our startup bookkeeping services and also get to know our fees. Keep in mind we establish our fee based on:

- Your company’s size.

- The complexity of the project.

- The number of transactions/services you may need.