Our Calculated Growth™ Model is designed to measure every decision’s financial impact on your business…and how you can leverage it.

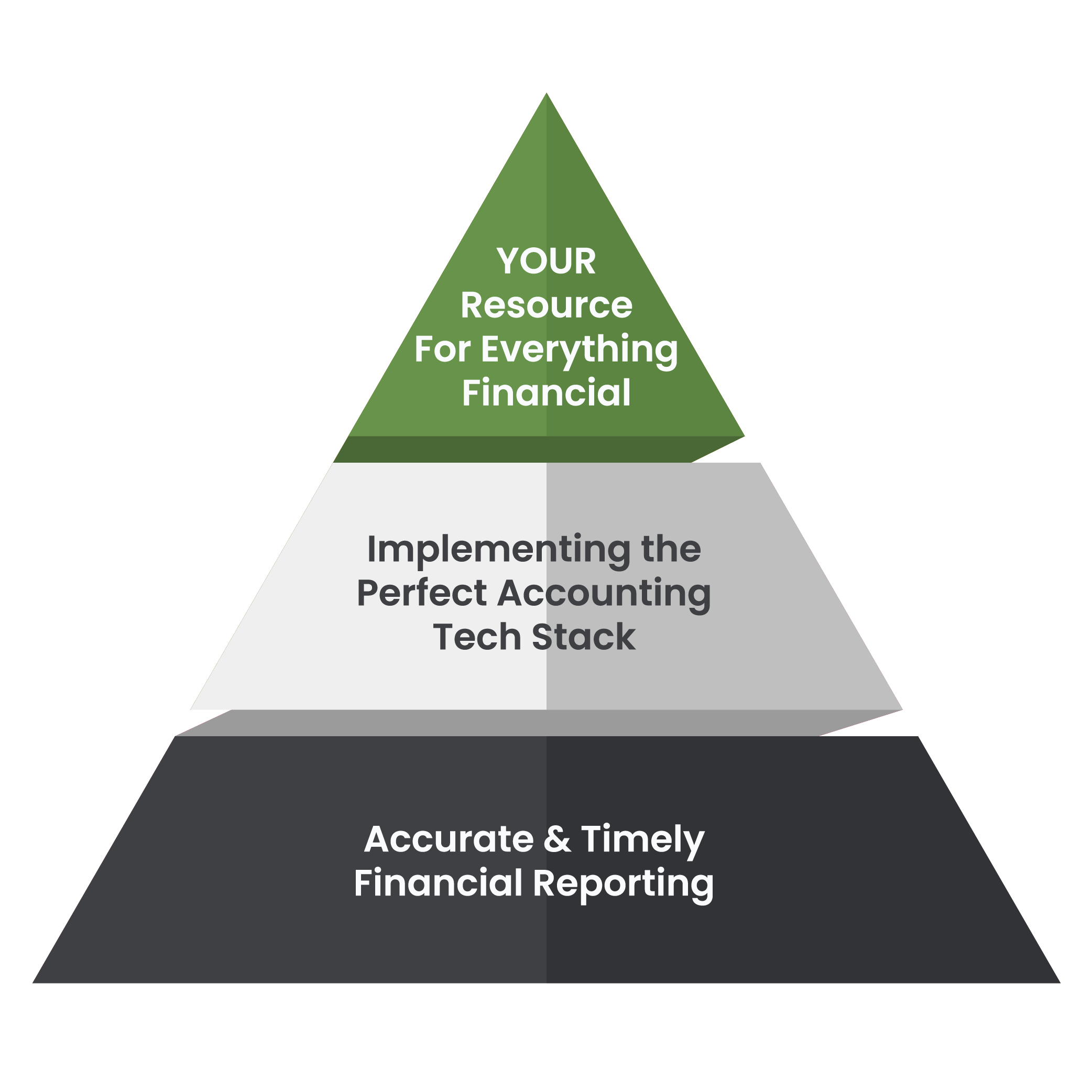

This model is implemented using a 3-pronged approach to make sure your growth is calculated and scalable. Please see our foundational chart below.

Not only does this model help to add more money to your bottom line through informed decision making, it helps to maximize the value of the business when you go to exit. The lack of proper systems in a business model is the No.1 reason why businesses fail to be sold…or get sold for less than they are worth.