Two of the greatest players from my generation were inducted into Cooperstown this weekend – Ken Griffey, Jr. and Mike Piazza. There are so many things I could write about Piazza but Griffey has a special place in my childhood memories.

I’ll never forget his years in Seattle during the early to mid ‘90s – “The Kid” was a natural. He had the sweetest left-handed swing, hit for power and average, stole bases, played elite defense in centerfield, and had a cannon for an arm. He was the quintessential definition of the “Five Tool Baseball Player” and he even had his own baseball video game. For his career he hit 630 home-runs and earned countless awards. Most of the baseball fans from my generation will be playing the “What If” game with his career the rest of our life, however. Griffey spent much of the latter part of his career on the disabled list and if he had stayed healthy, it’s feasible he could have been approaching 800 home runs before he retired.

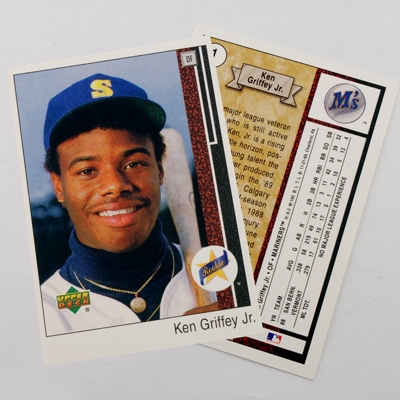

Will all this being said, when someone mentions Ken Griffey Jr. the first memory that pops into my heads is his 1989 Upper Deck rookie baseball card. Around that time I was an avid baseball card collector. As soon as I had any money I would look to buy as many packs of baseball cards that I could get my hands on. Every day after school I would meet up with friends, play some sports, and then trade baseball cards until we were forced to go home for dinner. Of all the baseball cards that we traded during those years, the 1989 Ken Griffey Jr. Upper Deck rookie baseball card was our most discussed and coveted. I remember when I first heard about this card I would constantly beg my mom to take me to the store to buy as many packs of Upper Deck baseball cards that I could afford. I remember the thrill of ripping open these fresh packs I bought hoping that I was lucky enough to have gotten the grand prize. Although I never ended up getting the card myself, I was able to swing a Herschel Walker-esque deal with one of my friends and still own it to this day.

Now, on to the question of the week which is another follow up from my articles about the home office deduction: I am thinking about writing off my home office this year, what type of receipts do I need to keep? Do I need to keep them all?

I’m glad that you are asking this question because I can’t even tell you how many times someone has asked me this. My general answer is that anything you put on your books and/or claim on your taxes should have support. This means that you should keep copies of receipts, cancelled checks, invoices, and any supporting document that make up all of your bottom line net income.

Although record-keeping can be time consuming, it has so many benefits. Below are a few key points to keep in mind:

- It helps your accountant prepare accurate financial statements for decision making purposes

- Sometimes the way you deduct an expense for your books is not how it is deducted for taxes. By having the proper supporting documents, your accountant will be able to help you maximize the deduction on your taxes.

- It provides basis for your taxes if you were selected for an IRS, state, or local income tax audit. Without ample support, the taxing authority may disallow all of part of a deduction. This would mean more taxes to pay along with penalties and interest.

I know you didn’t ask this specifically but another important part of this topic is the length of time to keep your records on file. The general answer to this is a minimum of 3 years but I would refer to the IRS on how to long to keep your records. If you have more specific situations or want to brush up on all of the details, please prefer to IRS Publication 583.

Please feel free to contact me with any comments, questions, or concerns you may have!